You may not have considered it before, but gold investment is something that deserves your attention. In a world of unpredictable economies and fluctuating markets, gold has proven to be a reliable and stable investment option. Whether you are a seasoned investor or just starting out, the allure of gold is hard to resist. Its value has stood the test of time and has consistently outperformed other investment choices. So, if you’re looking for a safe and secure way to protect and grow your wealth, perhaps it’s time to give gold investment a closer look.

Historical Performance

Consistent value appreciation over time

Gold has a long history of providing consistent value appreciation over time. For centuries, gold has maintained its value and even increased in price, making it a reliable and profitable investment option. Whether it’s a small-scale investor or a large institution, gold has consistently shown its ability to protect and grow wealth.

Stable against economic downturns

During economic downturns, when traditional investments like stocks and bonds may plummet in value, gold has proven to be a stable and reliable asset. Its value remains relatively unaffected by market fluctuations, making it an essential addition to any investment portfolio. When other assets are struggling, gold often shines as a safe haven during times of economic uncertainty.

Safe haven investment

One of the key reasons gold is considered a safe haven investment is its ability to preserve value in times of crisis. Whether it’s a financial collapse, geopolitical tensions, or a global pandemic, gold has historically held its value and even increased during these uncertain times. Investors turn to gold as a hedge against economic and political instability, relying on its time-tested ability to provide security and stability.

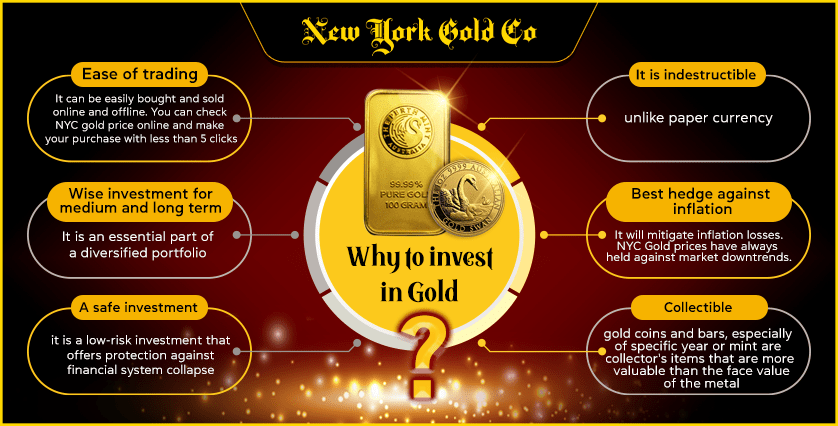

Inflation Hedge

Maintains purchasing power

Gold serves as a hedge against inflation, as it has proven to maintain its purchasing power over long periods. Unlike paper currency or other assets that may be impacted by inflation, gold has historically retained its value. By holding gold, investors can preserve their wealth and purchasing power, ensuring that their savings will not be eroded by rising prices.

Preserves wealth during inflationary periods

In times of high inflation, gold has been known to outperform other investments. As the value of paper currency declines, gold becomes more valuable, providing a buffer against the eroding effects of inflation. Investors who allocate a portion of their portfolio to gold can protect their wealth and potentially even see it appreciate during inflationary periods.

Protection against currency devaluation

When a country’s currency is devalued or experiences significant fluctuations, gold serves as a form of protection. As a tangible asset, gold’s value remains unaffected by currency devaluations. Investors who hold gold can weather the storm of currency devaluation, ensuring that their wealth remains intact regardless of the economic conditions.

Diversification Benefits

Balancing investment portfolio

Diversification is a fundamental principle of investing, and gold offers an excellent opportunity to balance an investment portfolio. By adding gold to a portfolio that includes stocks, bonds, and other assets, investors can spread their risk and potentially enhance their overall returns. Gold’s low correlation with other asset classes makes it an effective diversification tool.

Reducing overall risk

Investing solely in one asset class exposes investors to significant risks. By diversifying with gold, investors can reduce the overall risk in their portfolio. Gold’s lack of correlation with traditional assets provides a level of protection, ensuring that losses from one asset class can be mitigated by the positive performance of gold.

Counteracting volatility in other asset classes

Gold’s ability to counteract volatility in other asset classes makes it a valuable addition to any investment portfolio. While stocks, bonds, and real estate may experience substantial fluctuations, gold tends to hold its value or even increase during periods of instability. By including gold in a diversified portfolio, investors can offset the volatility of other investments and potentially increase overall returns.

Liquidity and Accessibility

Global market demand

Gold enjoys a global market demand, making it a highly liquid asset. Whether you’re looking to buy or sell gold, there is a robust market that operates around the clock. This global demand ensures that investors can easily access gold and convert it into cash whenever needed.

Easily tradable

Gold’s widespread acceptance and recognition make it easily tradable across different markets and countries. Its standardized weight and fineness make transactions straightforward and efficient. Whether it’s through established bullion dealers, jewelry stores, or online platforms, investors can easily buy or sell gold without encountering significant barriers.

Liquid asset with multiple investment options

Investors can access gold in various forms, making it a highly flexible and liquid asset. From physical gold bars and coins to gold-backed exchange-traded funds (ETFs) and mutual funds, there are multiple investment options available to suit individual preferences and financial goals. This versatility ensures that investors can easily adjust their gold holdings to meet their changing needs.

Store of Value

Historically recognized as valuable

Gold’s value has been recognized throughout history and across different cultures. It has been used as a medium of exchange, a unit of account, and a store of value for thousands of years. The enduring recognition of gold’s value adds to its appeal as a reliable store of wealth and a hedge against financial uncertainty.

Cultural and symbolic significance

Gold holds cultural and symbolic significance in many societies. It is often associated with luxury, wealth, and power. From ancient civilizations to modern times, gold has been used in various religious, ceremonial, and decorative objects. Its cultural and symbolic importance further solidifies its position as a store of value and an enduring investment option.

Inter-generational wealth transfer

Gold’s status as a store of value also makes it an attractive option for inter-generational wealth transfer. The durability and long-term value of gold make it an ideal asset to pass down to future generations. By holding gold, individuals can ensure that their wealth is preserved and can be passed on to their loved ones, contributing to their financial security and stability.

Portfolio Protection

Risk hedging during market uncertainties

During times of market uncertainties, gold serves as a reliable risk-hedging tool. Its ability to hold value or appreciate in price amid market turbulence helps protect investors’ portfolios from significant losses. By including gold in their portfolio, investors can mitigate the negative impact of market downturns and potentially enhance their overall returns.

Wealth preservation during economic crises

Economic crises can pose significant threats to investors’ wealth. However, gold has consistently demonstrated its ability to preserve wealth during these challenging times. Whether it’s a recession, financial collapse, or any other crisis, gold’s reputation as a safe haven becomes especially relevant. By allocating a portion of their portfolios to gold, investors can better safeguard their wealth and navigate through economic storms.

Financial insurance against geopolitical events

Geopolitical events, such as political instability, trade disputes, or military conflicts, can have a profound impact on financial markets and investments. Gold serves as a form of financial insurance in such situations. Its stability and universal recognition make it an attractive asset for investors seeking to protect their wealth from the potential consequences of geopolitical events.

Supply and Demand Dynamics

Limited supply and increasing demand

The supply of gold is limited, as it is a finite resource. Gold mining production has its constraints, and new discoveries of significant gold deposits are becoming rarer. At the same time, the demand for gold continues to increase, driven by emerging markets and technological advancements. This combination of limited supply and growing demand creates a favorable environment for potential price appreciation of gold.

Industrial and jewelry market demand

Gold’s demand extends beyond investment purposes. It plays a crucial role in various industries, such as electronics, telecommunications, and medical devices. Additionally, gold’s allure as a precious metal makes it highly sought after for jewelry and other luxury goods. The robust demand from these sectors adds to gold’s overall value and market stability.

Central bank gold reserves

Central banks around the world hold substantial gold reserves as part of their foreign exchange reserves. These reserves are a testament to gold’s enduring appeal and reliability. Central banks consider gold as a strategic asset, providing stability to their currencies and offering a hedge against economic uncertainties. The significant holdings of gold by central banks further validate its role as a valuable investment.

Tax Advantages

Tax benefits in some jurisdictions

In certain jurisdictions, investing in gold can offer tax benefits. These benefits may include exemptions or reduced rates on taxes such as capital gains tax or sales tax. By taking advantage of these tax incentives, investors can enhance their overall returns and optimize the tax efficiency of their gold investments.

Gold-backed IRAs

Gold-backed Individual Retirement Accounts (IRAs) provide another avenue for tax advantages. By investing in gold through an IRA, investors can enjoy the benefits of tax deferral on their gold holdings. This means that any potential profits from the appreciation of gold are not subject to immediate taxation, allowing investors to accumulate wealth while deferring their tax liability.

Capital gains tax treatment

The tax treatment of capital gains on gold investments may vary depending on the jurisdiction and the holding period. In some cases, long-term capital gains from gold investments may be subject to preferential tax rates, reducing the tax burden on investors. Understanding the tax implications and taking advantage of favorable tax treatment can significantly impact the after-tax returns of gold investments.

Global Currency

Accepted worldwide as a form of payment

Gold has universal acceptance as a form of payment. While not commonly used for day-to-day transactions, gold can be easily converted into local currency when needed. In times of financial instability or when traditional currencies lose value, gold can step in as a reliable and widely accepted medium of exchange.

Protection during currency fluctuations

Currency fluctuations can erode the value of assets denominated in a particular currency. However, gold provides a hedge against such fluctuations. Its value remains relatively stable, and even appreciates, during periods of significant currency volatility. By holding gold, investors can protect their wealth from the potential negative effects of currency fluctuations.

Preserves wealth across international borders

Gold’s global acceptance and recognition make it an ideal asset for preserving wealth across international borders. Whether it’s for diversification purposes or to protect against political and economic risks in a specific country, gold offers a portable and stable store of value. Investors can easily transport and exchange gold internationally, maintaining their purchasing power in different markets and jurisdictions.

Future Potential

Emerging markets creating demand

As emerging markets continue to grow and prosper, the demand for gold is expected to rise. The rising middle class in countries like China and India, coupled with increasing disposable incomes, has led to a surge in demand for gold for both investment and cultural purposes. This growing demand presents an opportunity for investors to capitalize on the future potential of gold.

Technological and industrial applications

Gold’s unique properties, such as its excellent conductivity and resistance to corrosion, make it indispensable in various technological and industrial applications. From electronics to aerospace, gold plays a vital role in manufacturing high-tech products. As technology continues to advance, the demand for gold in these sectors is likely to grow, further contributing to its value.

Green investment opportunities in gold mining

The increasing focus on sustainability and environmental responsibility has led to the emergence of green investment opportunities in gold mining. Responsible mining practices and innovative technologies are improving the industry’s environmental footprint. Investing in companies that adopt these sustainable practices can provide both financial returns and positive impact on the environment, making gold mining an attractive option for socially conscious investors.

In conclusion, gold investment deserves attention due to its historical performance, inflation hedging properties, diversification benefits, liquidity and accessibility, store of value attributes, portfolio protection qualities, supply and demand dynamics, tax advantages, global currency acceptance, and future potential. Whether you’re an experienced investor or just starting to explore investment options, considering gold as part of your portfolio can offer stability, wealth preservation, and potential long-term growth. With its enduring value and numerous advantages, gold remains a timeless asset worth considering.